|

| Action Insight | Candlesticks Trades | Markets Summary | Action Bias | Top Movers | Daily Technicals |

| Calendar | Elliott Wave Trades | Markets Volatility | Pivot Points | Heat Map | Daily Fundamentals |

| Action Insight Market Overview | Markets Snapshot |

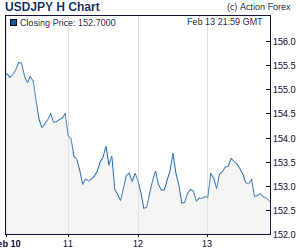

Daily Report: Yen Broadly Lower With EUR/JPY, AUD/JPY Taken Out Key ResistanceThe Japanese yen falls across the board this week as risk appetite continues to rebound from the low post natural disaster in Japan. DOW rose 81 pts overnight and closed strongly near to this week's high. Asian equities also followed with Nikkei up nearly 200pts. EUR/JPY has taken out key near term resistance on ECB rate expectations. AUD/JPY also broke key resistance level as carry trade returns. Judging from the relative reaction to risk appetite and the strength in USD/JPY, the Japanese yen is back to be the most favored funding currency for carry trades. Comments from Fed Plosser and Bullard raised some possibility that Fed could start normalizing policies earlier than expected and support dollar comparing to the yen. | |

| Featured Technical Report | |

EUR/JPY Daily OutlookDaily Pivots: (S1) 114.37; (P) 114.84; (R1) 115.52; More EUR/JPY jumps to as high as 116.94 so far today and the strong break of 115.96 suggests that the medium term trend might have reversed. Intraday bias remains on the upside for the moment and further rise should be seen to 38.2% retracement of 139.21 to 105.42 at 118.33 first. Break will affirm the bullish case and target 61.8% projection of 106.57 to 115.53 from 113.54 at 119.07 next. On the downside, break of 113.54 support is now needed to signal short term topping. Otherwise, outlook will remain bullish. |

| Economic Indicators Update | Learn Expert Strategies for Pulling Profits from the Markets. The London Traders Expo on April 8-9, 2011 at the Queen Elizabeth II Conference Centre. Visit The London Traders Expo online to register FREE. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Forex Trade Ideas | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Trade Idea: USD/CHF – Hold long entered at 0.9155Although current breach of resistance at 0.9235 confirms recent upmove from 0.8853 low has resumed and a stronger retracement of early decline towards previous support at 0.9269 is likely, loss of near term upward momentum should prevent sharp move beyond there and previous minor resistance at 0.9316 should hold. Trade Idea: EUR/USD – Hold short entered at 1.4115Although the single currency rebounded after yesterday's retreat from 1.4149 to 1.4047, as euro met renewed selling interest at 1.4128 this morning and has fallen again, retaining our bearishness for decline from 1.4249 top to resume after consolidation, break of 1.4047 would add credence to this view, bring test of 1.4021, then 1.4000 but reckon support at 1.3980 would hold on first testing, bring rebound later. Candlesticks Intraday Trade Ideas Update Schedule (GMT): Elliott Wave Daily Trade Ideas Update Schedule (GMT): | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Suggested Readings | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fundamental Highlights

Technical Highlights | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

No comments:

Post a Comment