|

| Action Insight | Candlesticks Trades | Markets Summary | Action Bias | Top Movers | Daily Technicals |

| Calendar | Elliott Wave Trades | Markets Volatility | Pivot Points | Heat Map | Daily Fundamentals |

| Action Insight Market Overview | Markets Snapshot |

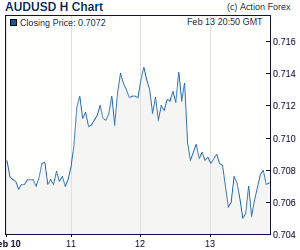

Daily Report: Risk Sentiments Recover, Euro Rebound Limited by Portugal DowngradeOversold risk sentiments recover mildly today as markets are calming down from nuclear crisis in Japan and got some help from a relatively more upbeat Fed statement. DOW managed to pared most of the intraday losses and closed just down -1.15% overnight. Japanese Nikkei also recovered after yesterday's record selloff and is back above 9000 level. Dollar is weak in general against Euro, Swissy and Yen even though it's maintaining gains against Aussie and Loonie. In particular, USD/CHF remains soft after making new record low at 0.9140 yesterday while USD/JPY is still on the way to 80 psychological level. | |

| Featured Technical Report | |

USD/JPY Daily OutlookDaily Pivots: (S1) 80.19; (P) 81.12; (R1) 81.63; More. Intraday bias in USD?JPY remains on the downside for 80.29 support. As noted before, current development suggests that consolidation pattern from 80.29 has completed at 83.96 already and the larger down trend is likely resuming. Break of 80.29 will target 79.75 (1995 low) next. On the downside, above 81.23 minor resistance will turn intraday bias neutral and bring recovery. But upside should be limited well below 83.28 resistance and bring fall resumption. |

| Special Reports |

Fed On Hold, Economic Assessments More BullishAs expected, the Fed left the policy rate unchanged at 0-0.25% and the asset-buying program at $600B with expiry in June. The language used in the meeting statement was more upbeat though, reflecting improvements in economic outlook since the January meeting. Fed members upgraded their assessment on the economic outlook and affirmed that they are paying 'close attention to the evolution of inflation and inflation expectations'. Yet, there were no comments on the situation in the Middle East and North Africa nor Japan's earthquake. SNB To Pause Again, But Faces Pressure To Hike Rates Earlier Than Previously ScheduledRecent hawkish comments from the ECB have spurred discussions about rate hikes in the SNB. The pace of recovery in Switzerland accelerated in 2010 after the country emerged out of recession in mid-2009 while inflation has remained subdued. The SNB has kept the 3-month Libor target range unchanged after taking to a record low of 0-0.75% in March 2009 although policymakers believes that 'the current expansionary monetary policy cannot be maintained over the entire forecast horizon without compromising long-term price stability'. A reason keeping policymakers from tightening is strength in Swiss franc which may somehow take a breather as the ECB plans to hike in April. Concerning economic forecasts, we expect the central bank will lift its forecasts on growth and inflation at the meeting. |

| Economic Indicators Update | Learn Expert Strategies for Pulling Profits from the Markets. The London Traders Expo on April 8-9, 2011 at the Queen Elizabeth II Conference Centre. Visit The London Traders Expo online to register FREE. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Forex Trade Ideas | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Trade Idea: GBP/USD – Sell at 1.6135Cable's rebound after yesterday's fall to 1.5978 suggests further consolidation above last week's low at 1.35977 would take place as suggested in our previous update and recovery to the Ichimoku cloud top (now at 1.6127) cannot be ruled out, however, reckon 1.6160/70 would hold, bring another decline later. A break of said support at 1.5977 would confirm the decline from 1.6344 top has resumed Trade Idea: USD/JPY – Sell at 81.60Despite yesterday's marginal fall to 80.60, lack of follow through selling on the break of previous support at 80.62 suggests consolidation would take place and recovery to the Kijun-Sen (now at 81.25) cannot be ruled out, however, renewed selling interest should emerge below the Ichimoku cloud bottom (now at 81.68), bring another decline later. A break of said support at 80.60 would extend the decline from 83.30 to 80.40 Candlesticks Intraday Trade Ideas Update Schedule (GMT): Elliott Wave Daily Trade Ideas Update Schedule (GMT): | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Suggested Readings | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fundamental Highlights

Technical Highlights

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

No comments:

Post a Comment