|

| Action Insight | Candlesticks Trades | Markets Summary | Action Bias | Top Movers | Daily Technicals |

| Calendar | Elliott Wave Trades | Markets Volatility | Pivot Points | Heat Map | Daily Fundamentals |

| Action Insight Market Overview | Markets Snapshot |

Daily Report: BoJ Expands Asset Purchase, Inject LiquidityThe Bank of Japan announced to increase the size of the Asset Purchase Program JPY 5T to JPY 40T in total. Also, the bank injects additional liquidity to the financial system in an attempt to curb the negative impacts of the 9.0-magnitude earthquake that struck the country last week. The central bank will inject a record JPY 15T of emergency funds to the market as it is unable to respond with a reduction in the policy rate which has been staying at virtually 0%. In addition, the BOJ offered to by JPY 3T of government bonds from lenders in repo agreements from March 16. More in BOJ Inject Money To Financial Markets. Earlier today, Yen was sold off after the liquidity announcement as well as on concern of intervention. Finance Minister Noda said "it is time to closely watch" the yen's movement. A senior FM official warned of the possibility of intervention to help exporters. | |

| Featured Technical Report | |

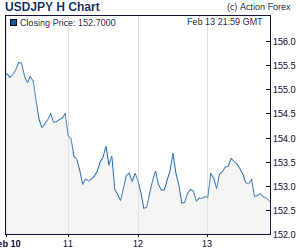

USD/JPY Daily OutlookDaily Pivots: (S1) 81.23; (P) 82.26; (R1) 82.87; More. USD/JPY's strong rebound from 81.20 suggests that a temporary low is in place and bias is turned neutral. Also, recent consolidation from 80.29 is still in progress. for more choppy sideway trading. Though, we'd favor another fall as long as 83.28 resistance holds and expect an eventual downside break. Below 81.20 will bring a test on 80.29 low first. |

| Special Reports |

BOJ Inject Money To Financial MarketsThe Bank of Japan announced to inject additional liquidity to the financial system in an attempt to curb the negative impacts of the 9.0-magnitude earthquake that struck the country last week. The central bank will inject a record 15 trillion yen of emergency funds to the market as it is unable to respond with a reduction in the policy rate which has been staying at virtually 0%. In addition, the BOJ offered to by 3 trillion yen of government bonds from lenders in repo agreements from March 16. EU Summit - A Pleasant Surprise on Agreements ReachedThe summit held by EU financial leaders last Friday was a constructive one. Agreements were reached before the full EU summit on March 24/25 and the outcomes should be positive for the euro, at least in the near-term. In shorts, adjustments were made on the size of the EFSE, assets the facility is allowed to buy, interest rates and maturities of loans to Greece. Meanwhile, the 'Pact for the Euro' was designed to improve policy coordination, enhance competitiveness, achieve greater convergence and build confidence for the Eurozone. |

| Economic Indicators Update | Learn Expert Strategies for Pulling Profits from the Markets. The London Traders Expo on April 8-9, 2011 at the Queen Elizabeth II Conference Centre. Visit The London Traders Expo online to register FREE. | ||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||

| Forex Trade Ideas | |||||||||||||||||||||||||||||||||||||||||||

Trade Idea: USD/CHF – Sell at 0.9335Although the greenback fell briefly to 0.9258 earlier today, lack of follow through selling on the break of 0.9269 support and the subsequent rebound on the back of intra-day rally in USD/JPY suggest further consolidation would take place. Above the Kijun-Sen (now at 0.9309) would bring another bounce to 0.9335/40, however, resistance area at 0.9363-70 should remain intact, bring another decline later. Trade Idea: GBP/USD – Buy at 1.6010Despite intra-day euro-led rise to 1.6100, as the British pound has retreated after faltering below the Ichimoku cloud bottom, suggesting consolidation would take place and weakness to the Kijun-Sen (now at 1.6037) cannot be ruled out, however, reckon 1.6000/10 would limit downside and bring another rebound later. Above the lower Kumo (now at 1.6093) would bring another leg of corrective rise for retracement of recent decline to 1.6116-25 Candlesticks Intraday Trade Ideas Update Schedule (GMT): Elliott Wave Daily Trade Ideas Update Schedule (GMT): | |||||||||||||||||||||||||||||||||||||||||||

| Suggested Readings | |||||||||||||||||||||||||||||||||||||||||||

Fundamental Highlights

Technical Highlights | |||||||||||||||||||||||||||||||||||||||||||

No comments:

Post a Comment